What It is & How It works [+ Examples]

페이지 정보

본문

1,220,000 of the price of qualifying new or used property and tools purchases automatically for the 2024 tax year. One in all some great benefits of this deduction is that you’ll instantly obtain tax savings from the purchase of an asset reasonably than progressively saving taxes via depreciation in future years. Section 179 is elected by finishing Half 1 of IRS Form 4562. This type summarizes your depreciation expense and is included with your business return. Investments made in designated Certified Opportunity Zones can present vital tax advantages. These zones intention to advertise funding in economically disadvantaged areas. 8. Make the most of tax advantages of energy-environment friendly investments and renewable energy: Utilizing tax benefits related to power-environment friendly investments and renewable energy can be a strategic transfer for businesses aiming to cut back their environmental impression and lower their tax liability. Listed below are some key power credit concerns: Energy-Environment friendly Property Deductions, Renewable Power Investment Tax Credit (ITC), Renewable Energy Manufacturing Tax Credit (PTC), and others.

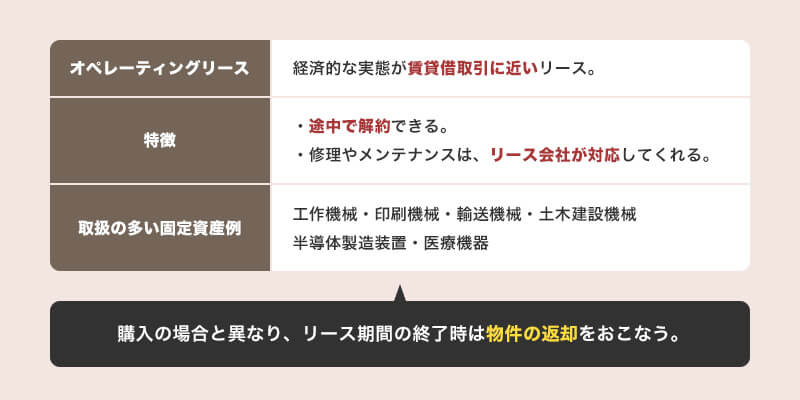

Lease changes measure contract modifications similar to a lease extension or enlargement, and the impairment transaction that makes use of the appropriate-of-use asset for non-recoverable costs. Asset leasing integrates with General ledger to ensure that every one posted lease transactions replace your chart of accounts. Asset leasing integrates with Accounts payable to trace lessor invoices in Accounts payable and take future payments from there. If none of these apply, the lease is labeled as operating. With the adoption of ASC 842 and IFRS sixteen, most leases now appear on the balance sheet. This change enhances transparency however reduces the flexibleness beforehand related to operating leases. Tax treatment varies based mostly on lease classification. Capital leases permit lessees to deduct each depreciation on the leased asset and interest on the liability. At Marcum, you benefit from tax professionals in quite a lot of advisory and compliance areas working together to drive the most effective tax methods for your enterprise. In addition, corporate tax staff members advise Marcum assurance clients and are valued assets to different companies that need an impartial specialist agency to serve as an extension of the management group in tax planning issues. Steadily, as a consequence of independence issues, giant accounting firms and オペレーティングリース 節税スキーム their shoppers look to Marcum for help with tax provision preparation and special tax tasks.

What Does Depreciation Let you know? Depreciation calculations determine the portion of an asset's cost that may be deducted in a given yr. Relying on the strategy used, the quantity could also be the same every year. Or, it could also be larger in earlier years and decline yearly over the life of the asset. There are 4 allowable methods for calculating depreciation, and which one a company chooses to use depends on that company's particular circumstances. Small businesses in search of the simplest method may choose straight-line depreciation, which merely calculates the projected common yearly depreciation of an asset over its lifespan. Since completely different assets depreciate in alternative ways, there are other ways to calculate it. Declining steadiness depreciation allows firms to take bigger deductions during the sooner years of an belongings lifespan. Sum-of-the-years' digits depreciation does the identical factor however less aggressively. Lastly, units of production depreciation takes an entirely totally different method by utilizing items produced by an asset to determine the asset's value.

- 이전글The Advanced Guide To Replacing Double Glazed Window Handle 24.12.27

- 다음글Why Tilt And Turn Window Handles Doesn't Matter To Anyone 24.12.27

댓글목록

등록된 댓글이 없습니다.